After the US Supreme Court ruling, sales tax calculation and the collection became more complicated as the Supreme Court has allowed state-by-state legislation. This means that after June 2018, businesses now have to pay the sales tax on e-commerce transactions whether your business has a physical store or not. Also, if your business is in one state and you are selling your product in another state, you have to pay the taxes according to that state’s tax rules. If your website is built using WooCommerce, then this process of tax calculation is easier, you can choose one of the following WooCommerce sales tax plugins. For basic uses, these will help you calculate the tax rates according to your customer’s state or area.

Better customer experience means more conversions. Try out WooCommerce Product Add-Ons.

Best WooCommerce Sales Tax Plugins

Here is a list of the best WooCommerce sales tax plugins for your eCommerce website, to save you from sales tax headaches.

1. TaxJar

“Spend Time on Your Business. Not Sales Tax.” – this is the slogan for the TaxJar WooCommerce plugin. It is a great WooCommerce extension to manage your sales tax effortlessly. Taxjar extension will calculate the US or Canadian sales tax that is updated monthly. That will reduce your stress on manually updating the tax rate CSVs. This plugin automatically calculates all the sales tax you need to pay to the state or country daily. If you buy a subscription or upgrade to premium plans, TaxJar will automatically file your state sales tax every month or year. With this, you don’t have to keep track of your tax rates and payment dates.

Also, Taxjar offers you a free 30-day trial and it doesn’t ask for your credit card. You don’t have to deal with any contracts in this process. The TaxJar plugin maintains over 10,000 tax rates and it updates all the tax rates regularly. Again, if your business uses eBay or such platforms, the TaxJar plugin is compatible with these also. TaxJar plugin will automatically compile all your tax data from these websites and save it in one place. Indeed, that will reduce a lot of stress.

Everyone knows that offering discounts and dynamic prices can increase sales. But what’s the best way to do it? Here you go WooCommerce Dynamic Pricing Plugins.

2. Avalara AvaTax

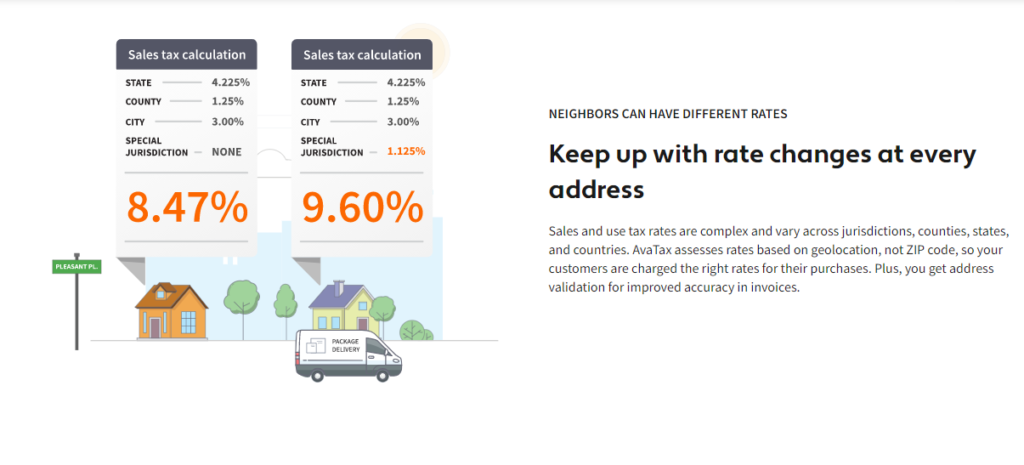

Avalara joined WooCommerce and introduced its product Avalara AvaTax plugin. AvaTax is a very similar service to the TaxJar plugin but it offers some customized features as well. AvaTax plugin offers sales tax calculation on the basis of geo-spatial mapping. By using this plugin on your WooCommerce website, you can set and apply individual tax schedules for your customers. Also, you can set tax exemptions for particular orders from your customers. Avatax plugin also allows you to manually submit the transaction you made with cash or check payments. With this manual input system, the AvaTax plugin will calculate all your business tax rates and will store them in one place.

Searching for POS plugins for WooCommerce? We got you covered with our detailed review of the

Best WooCommerce POS Plugins.

Again, if your business uses the subscription model, AvaTax has a solution for it as well. AvaTax has a unique feature that can differentiate between renewal tax and an initial order tax. That will assure that your customers won’t pay any extra tax payments while buying your product from your website. Also, the AvaTax plugin can manage your sales tax compliance across different companies. But this feature will not charge you a single dollar.

You can pay according to the volume of transactions that your business makes. AvaTax plugin also offers a 60-day money-back guarantee if you don’t like the service.

3. Quaderno

Quaderno is also a great sales tax plugin to keep track of all your sales tax. It helps to real-time sales tax rates in any country you want. Quaderno also follows the local tax laws of your customer that you set in the Quaderno plugin. It has a feature that generates automated tax receipts for each sale that is made from your website. This receipt is available in multiple languages and it shows different currencies according to the customers’ location. Quaderno plugin helps you fill the tax payments of the items sold from your website. It also offers an easy-to-use extensive reporting dashboard.

Also, if you are using several platforms to sell your products, Quaderno has a solution for it as well. It compiles the tax information across all platforms and shows it in one place. You don’t have to worry about the total tax on different platforms anymore. Quaderno plugin is also a very business-friendly plugin. You can track and verify your European Union customers’ VAT numbers by using this plugin. Also, you can send your customers the automatic VAT-exempted invoices.

You will also get notified when the tax rate changes in your customers’ state or country. Quaderno plugin always sends the updated tax rates to you so that you can get updated all the time.

4. Simple Sales Tax

The Simple Sales Tax plugin for WooCommerce simplifies the tax calculation and management procedure. It handles all the handwork for you and helps in calculating taxes, tax filing, and generating tax reports. This plugin integrates your store with TaxCloud, which is a cloud-based service and is an amazing tool for handling taxes.

Simple Sales Tax is very easy to install and set up. It provides users with detailed reports of tax collected on the city, state, and country levels. You can also avail of One-Click updates to benefit from the latest features. It also automatically files sales tax for you for free. In case of any troubleshooting, their expert customer support is available to help you out.

The TaxCloud service maintains an updated database of every tax jurisdiction in the US, thus you are filing taxes correctly always.

You can easily increase memberships on your website by using WooCommerce Membership Plugins.

5. Taxify

Taxify plugin apparently has been delisted from WordPress.org directory due to some “Guideline Violation”. So, we recommend using one of the other plugins listed above. If there is an update regarding the Taxify plugin we will update this article accordingly.

Taxify is a useful sales tax plugin for an E-commerce business. It is government-certified and has a clear pricing feature. It also offers real-time tax rates. With real-time tax rates, you get updated about the current tax rates for 50 states in the US and also local jurisdiction. It has other features like automated filing and remittance, transport reporting and audit trail, print-ready tax forms, self-service web portal, etc.

If you have customers all over the US, Taxify can calculate all the tax rates for you. By doing so, you can avoid late fees, tax gaps, etc.

Also, the Taxify plugin offers transparent reporting and audit trails so that you can control everything from your previous tax data to current fillings.

The Taxify plugin offers a variety of integrations. If your business is using different platforms like eBay, Amazon, and Shopify to sell products, Taxify helps you to manage tax payments for these websites. Taxify offers a simple way to manage your e-commerce business and overall sell by joining the integrations and top marketplaces you already use. Additionally, you can integrate Taxify with PayPal too.

Taxify has a customer support feature as well. Live experts are always available for you so that you don’t get in trouble with the tax payments.

Simplify the payment process using the best WooCommerce payment gateways.

Conclusion

Calculating sales tax is a tedious job for any store owner. It is also time-consuming to calculate taxes for each location. Thus, by using the best WooCommerce tax plugins, you can fully automate the tax calculation process and save yourself. Almost all of these plugins can calculate tax automatically once the customer’s address is mentioned, generate tax reports, and also file taxes.

By using these plugins, you do not have to worry about wrong tax calculation and or keeping up with the ever-changing tax rules for every state.